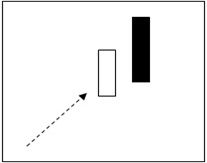

On the dark cloud cover day, the stock closes at least halfway into the previous white capping candle. The larger the penetration of the previous candle (that is , the closer this candle is a being a bearish engulfing), the more powerful the signal. Traders should pay particular attention to a dark cloud cover candle if it occurs at an important resistance area and if the end of day volume is strong.

In order for the Dark Cloud signal to be valid, the following conditions must exist:

- The stock must have been in a definite uptrend before this signal occurs. This can be visually seen on the chart.

- The second day of the signal should be a black candle opening above the high of the previous day and closing more than half way into the body of the previous day’s white candle.

For example